Despite the challenges public transit faced due to the pandemic, shared mobility grew in 2021. To understand the current state of shared mobility, and the impact on mobility services, we looked at bikeshare, scooter-share, and carshare data across the 25 largest metropolitan areas in the United States. We found that:

- Bikeshare and e-scooter programs grew.

- Dockless technologies such as e-bikes and adaptable scooters increased.

- Local regulations continued requiring shared mobility programs to include strategies for equitable access.

- The INVEST in America Act, which would fund a portion of needed sustainable infrastructure, passed in the Senate. The final house vote was scheduled for 9/30/2021. The House is still resolving differences before final approval.

Below is a summary of SUMCs’ findings by mode, and what we think we can expect to see in the coming year.

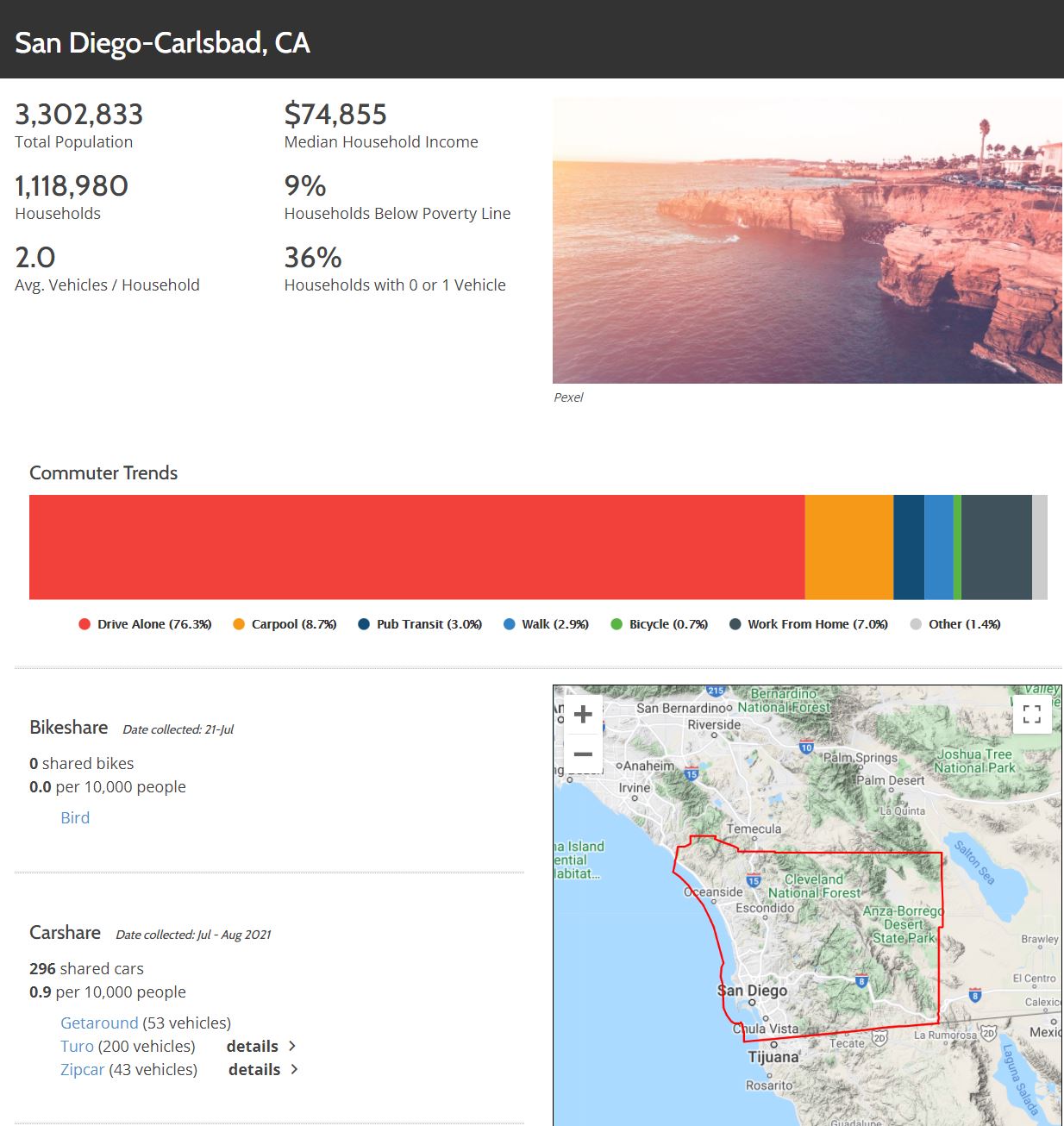

San-Diego Metro Profile, Shared-Use Mobility Center, 2021

Bikeshare Programs

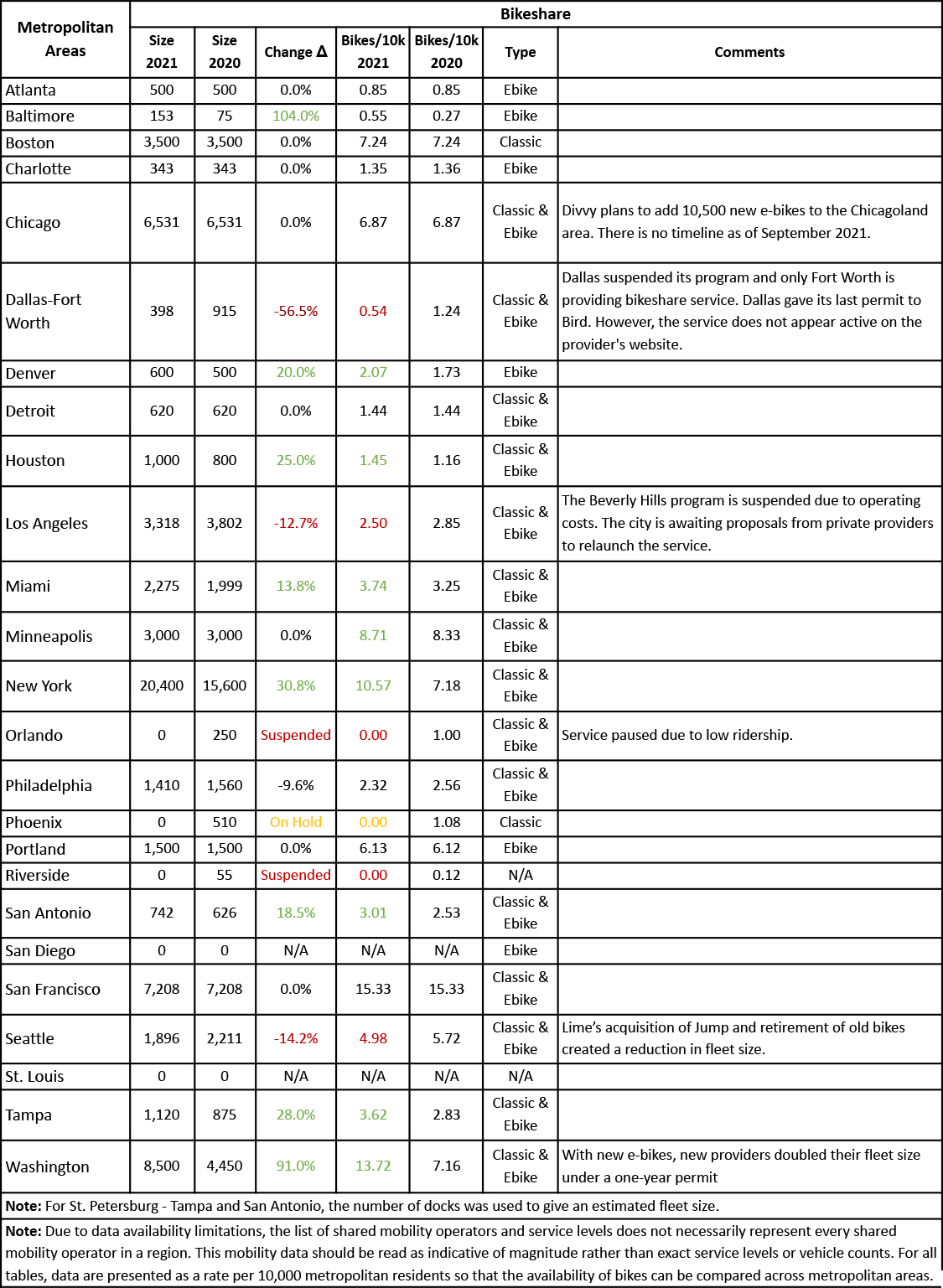

Biking boomed during the pandemic to the extent that the United States experienced a bicycle shortage in 2020. Ten out of the 25 areas studied expanded or made plans to expand their fleets, growing the total number by about 13%.

- Chicago plans to reach 16,500 bikes, more than doubling its fleet and covering every neighborhood in the city.

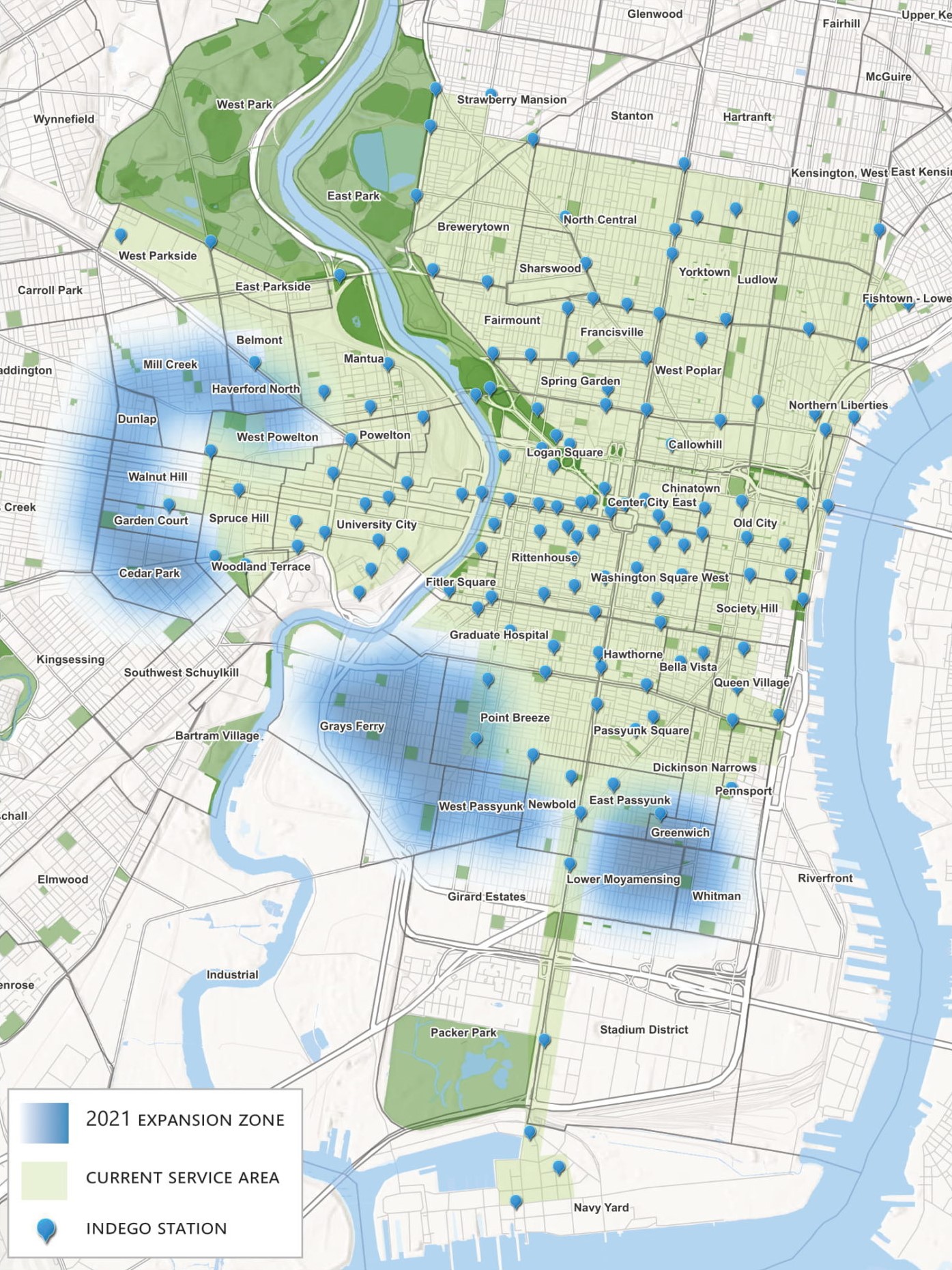

- Philadelphia is expecting to grow to 3,500 bikes in the next five years.

- The District Department of Transportation issued permits to DC Metro area providers to add dockless service that would double bikeshare capacity.

E-bikes are on the rise as well. San Antonio and St. Petersburg are transitioning to an electric bicycle fleet and San Diego authorized Bird to deploy 200 e-bikes in its most recent permitting cycle.

Philadelphia Bikeshare Expansion Plan, Indego, 2021

Bikeshare is not universal across the largest metropolitan areas

Three of the 23 bikeshare programs studied paused their services due to concerns of low ridership.

- The bikeshare program in Phoenix remains on hold after its pilot concluded in December 2020.

- Orlando is waiting for Lime-Wheels to start service this year after HOPR suspended its operation due to low ridership.

- Riverside, CA suspended its program after experiencing low ridership and vandalism. Beating the trend, Rialto is expecting a new bikeshare provider to launch 100 new e-bikes in 15 hubs around the city next year.

The table below shows the 25 metros reviewed in this analysis, estimated bikeshare fleet size, the presence of e-bikes, and the total bikeshare fleet per 10,000 metropolitan residents. For all of the modal data presented, the 2020 and 2021 data were collected roughly during the same periods in the summer and early fall.

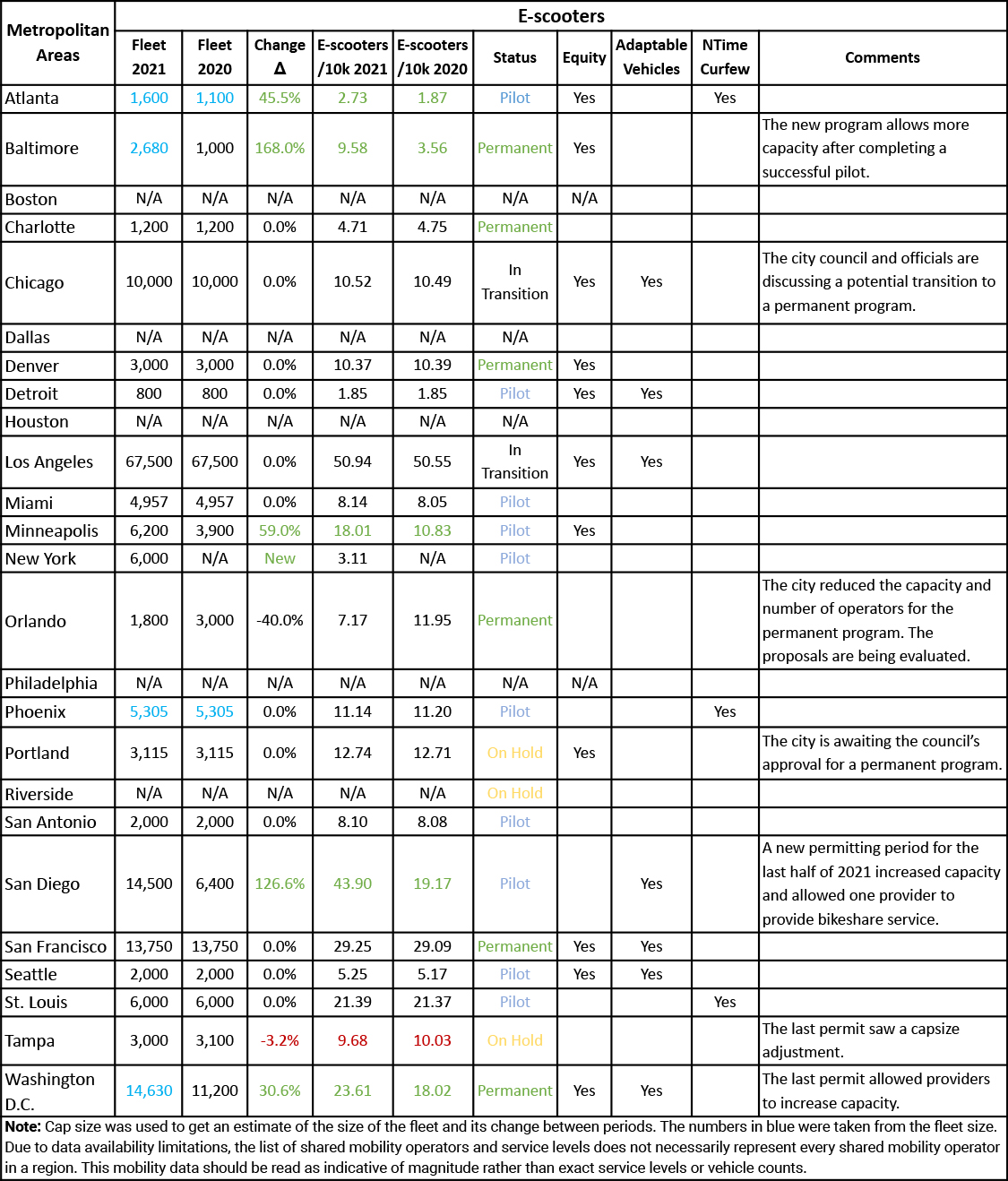

E-scooter Programs

17 of the 25 metropolitan areas studied have active e-scooter programs. From 2020 to 2021, e-scooter capacity grew by approximately 14%. New York City deployed 3,000 scooters in the East Bronx in its first pilot and Baltimore added a new provider to its program—Link—which launched 1,000 scooters across the city.

Heading west, San Diego renewed its e-scooter program in January 2021. By summer, it expanded its fleet size capacity by 49%. In Peachtree, Georgia, the city gave Tortoises’ remote-controlled scooters approval for a second pilot that will run until March 2022. The early success of these vehicles is prompting interest by companies like Spin, which sees remote repositioning as an opportunity to reduce the cost of parking compliance.

Adaptable Scooter, Boaz, 2021

Looking long term, Portland, Chicago, and Orlando are working to get approval to transition to permanent programs while Long Beach and Denver transitioned to permanent programs after hosting pilots.

The table below presents available data on e-scooter deployments and fleet caps (the maximum legal number of vehicles permitted in a jurisdiction, regardless of how many are deployed). These figures help support the idea that in order for e-scooters to be relied upon as a mode of travel, their availability needs to be wide enough to fully cover a market.

Dockless Regulation

Poor adherence to parking policies raised regulatory challenges to dockless bikeshare and e-scooter programs this past year. Other policy initiatives aimed at restricting use in the evenings and educating the public were instituted in 2021, examples include:

St. Louis is enforcing a nighttime curfew which restricts the use of scooters from 9 PM to 8 AM.

Miami is requiring providers to educate the community about the responsible use of e-scooters and prohibiting group rides at night. Due to scooter safety and security concerns.

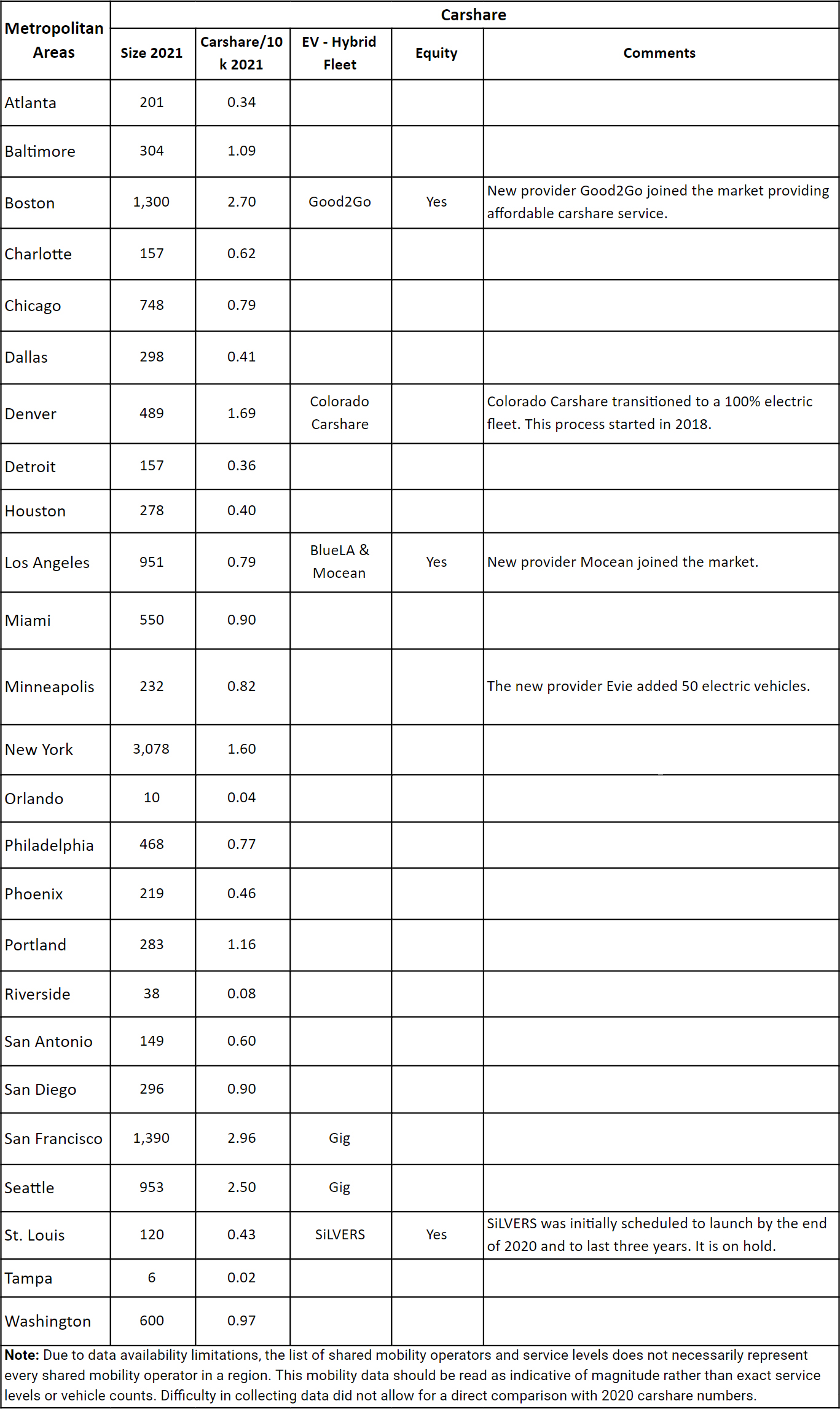

Carshare

As the US economy recovers from the COVID-19 pandemic and communities re-open, there has been a significant shortage of cars and car rentals. Despite this, Carshare remained relatively constant between the two time periods looked at in this summary while providers increased their use of electric vehicles.

- In 2021, the Los Angeles City Council gave approval for BlueLA to expand its charging stations and double its electric vehicle fleet to increase coverage and accessibility. The Los Angeles Department of Transportation’s new free-floating carshare service Mocean, is extending its service beyond West LA to serve the San Fernando Valley.

- In Boston, Good2Go is increasing its capacity in the Roxbury neighborhood, where the non-profit pilot is operating.

- The Twin Cities is preparing the launch of Evie with a fleet of 150 electric vehicles and 140 charging points.

Good2Go electric vehicle, Boston, 2021

The table below shows the estimated carshare fleets and shared cars available per 10,000 people.

Shared-Use Mobility Legislation

Bikeshare and e-scooter share

The Bipartisan Infrastructure Investment and Jobs Act will improve Safe Streets for All, guaranteeing better conditions and safety for pedestrians and micro-mobility users. This grant from the Federal Government provides funding to local authorities to invest in projects that help accomplish their Vision Zero plans, including protected infrastructure for bike users and sidewalks.

In addition, legislation that incentivizes the use of e-bikes is moving forward in congress. The Build Back Better Act proposes a 15% refundable consumer tax credit on the purchase of a new electric bicycle, with a maximum credit of $750 per bike and an $81 tax credit to cover the cost associated with commuting by bike. This act incentivizes the average driver who travels less than four miles to shift their automobiles for e-bikes.

Carshare

The INVEST in America Act proposes an investment of $7.5 billion to build out a national network of EV chargers, reducing one of the main barriers that electric vehicles face for widespread use. It also contains funding for the deployment of zero-emission transit and school buses.

Equity on the rise

As shared mobility programs expand, more cities are requiring that providers distribute their services to serve lower-income communities and include accessibility adaptations.

- In Denver, licensing agreements require providers to allocate bikeshare and e-scooter services in food deserts.

- In cities like Detroit and Santa Monica, e-scooter companies are providing a variety of accessible vehicles, like e-scooters with chairs or with three wheels, to better serve older adults and people with disabilities. In addition, there have been new programs for ADA compliance and measures to provide a public right of way.

- Seattle’s parking guidance campaign addresses educating users on how to park their dockless vehicles, maintaining sidewalks clear of obstruction.

New carshare providers are also contributing to equitable access in vulnerable communities.

In Boston, Good2Go is running a pilot that provides affordable services to an underserved neighborhood by providing a fleet of four electric vehicles and two parking spots—and they plan to serve another neighborhood by the end of this year. St. Louis expects to launch an all-electric carshare to serve older adults called SiLVERS, currently on hold due to the pandemic.

What to expect?

Bikeshare and e-scooter programs will continue to expand and e-bikes will play a role in that expansion. SUMC is hopeful that equity requirements will be more widespread along with implementation plans and advancements in accessible adaptions for older adults and people with disabilities. SUMC also sees a greater number of pilot projects shifting to permanent programs in the coming year(s).

Carsharing programs should also experience an increase in demand with a growing number of electric vehicles in their fleets and expectations of a national network of EV chargers.

SUMC is hopeful that shared mobility will continue to expand and provide, equitable, sustainable, affordable transportation for all.

Methods

The data collected for this analysis comes primarily from three types of sources: shared mobility providers, local transportation departments, and online news articles.

For bikeshare, the main data source included providers, which reported the size of their active fleets, followed by local transportation departments. For St. Petersburg, Tampa, and San Antonio, the number of their docks was used to give an estimate of the size of their fleet.

For e-scooters, the main source was transportation departments, which reported through their permits, capacity, and the number of active e-scooters, followed by news articles on e-scooter systems.

Carshare data involved a combination of sources depending on the providers. For Turo and Getaround, their websites were the main source. For Zipcar, the number of vehicles available for each metro area was identified by counting the availability of the vehicles in each service area map for each city.

The data discussed here and what is available on the MOD Learning Center should be read as indicative of magnitude rather than exact service levels or vehicle counts. This report was written by Director for the Learning Center & Accessibility Programs Albert Benedict, Communications and Public Affairs Director Leslie Gray, and Research Fellow at the Learning Center Hugo Coronado. Research was done by Hugo Coronado. If you have any questions, email Albert Benedict at albert@sharedusemobilitycenter.org.